Unlock the potential of your savings with a high-yield savings account offering over 4% APY. This guide provides a stress-free path to finding the best online savings accounts for maximizing your interest earnings from home. Discover how to effortlessly grow your money with our expert tips on comparing rates and understanding the benefits of high-interest savings.

Chapter 1: Introduction to High-Yield Saving

Understanding High-Yield Savings Accounts

High-yield savings accounts (HYSAs) offer a compelling alternative to traditional savings accounts, especially for those seeking to maximize their interest earnings from the comfort of their homes. These accounts typically provide higher interest rates, often exceeding 4%, which can significantly boost your savings over time. Understanding how these accounts work is crucial for anyone looking to improve their financial situation without the need for complex investments or the stress of active trading.

One of the key features of high-yield savings accounts is their online accessibility. Unlike traditional banks, many financial institutions offering HYSAs operate entirely online, which allows them to reduce overhead costs and pass those savings onto their customers in the form of higher interest rates. This means you can manage your savings easily through mobile apps or websites, making it convenient to monitor your account and make deposits or withdrawals at any time.

Moreover, HYSAs are FDIC-insured, meaning your deposits are protected up to $250,000 per depositor, per insured bank. This insurance adds a layer of security to your savings, making it a safe option for those wary of riskier investment vehicles. By choosing a reputable bank or credit union that offers high-yield accounts, you can enjoy peace of mind knowing your money is secure while still earning competitive interest rates.

It’s also important to consider the terms and conditions associated with high-yield savings accounts. While many offer attractive rates, they might come with certain requirements, such as maintaining a minimum balance or making a specified number of transactions each month. Understanding these stipulations can help you avoid fees that could negate the benefits of the higher interest rate, ensuring that your savings grow as intended.

In conclusion, high-yield savings accounts represent a smart, stress-free way to earn 4%+ interest on your savings without leaving your home. By taking the time to research and choose the right account, you can effectively enhance your financial situation while enjoying the convenience of online banking. As you build your savings, remember to regularly assess your account to ensure it continues to meet your needs and aligns with your financial goals.

Benefits of High-Yield Savings

High-yield savings accounts have become a popular option for individuals seeking to maximize their savings without the risks associated with the stock market. These accounts often offer interest rates significantly higher than traditional savings accounts, sometimes exceeding 4%. This means that your money can grow more effectively, allowing you to reach your financial goals with less effort and stress.

One of the primary benefits of high-yield savings accounts is their accessibility. Unlike investment accounts that might require a minimum balance or a lengthy application process, most high-yield savings accounts can be opened quickly and easily online. This convenience allows you to start earning interest on your savings almost immediately, without the need to leave the comfort of your home.

Additionally, high-yield savings accounts typically come with fewer fees compared to other savings options. Many banks offer these accounts with no monthly maintenance fees or minimum balance requirements. This characteristic makes them an excellent choice for those who want to save without incurring unnecessary costs, thereby maximizing the interest accrued over time.

Another significant advantage is the safety that high-yield savings accounts provide. Most of these accounts are insured by the FDIC up to $250,000, which means your funds are protected even in the unlikely event of a bank failure. This level of security allows savers to feel confident that their money is safe while still benefiting from higher interest rates.

Lastly, high-yield savings accounts encourage good savings habits. By offering attractive interest rates, they motivate individuals to save more and spend less. This positive reinforcement can lead to better financial management and a more secure future, making high-yield savings accounts an essential tool for anyone looking to improve their savings strategy without the stress of complicated investment options.

The Importance of Earning 4%+ Interest

In today’s financial landscape, earning 4% or more interest on your savings is not just a luxury; it’s a necessity for building a secure financial future. High-yield savings accounts offer an effective solution for individuals seeking to maximize their savings without the complexities of investing in the stock market. By taking advantage of these accounts, you can ensure that your money works harder for you while maintaining the safety of your funds.

The significance of earning 4%+ interest becomes evident when we consider inflation. As the cost of living rises, the purchasing power of your savings diminishes. A high-yield savings account can help combat this erosion by providing returns that outpace inflation, allowing you to preserve your wealth over time. This financial strategy is particularly crucial for those who may not have the time or resources to engage in active investment strategies.

Furthermore, high-yield savings accounts are accessible and user-friendly, making them ideal for individuals who prefer a stress-free approach to saving. Unlike traditional savings accounts that might offer minimal interest rates, these high-yield options can significantly enhance your savings potential. By simply opening an account online, you can start earning higher interest rates without any complicated procedures or fees.

Another advantage of high-yield savings accounts is their liquidity. Unlike other investment vehicles that may require you to lock up your funds for extended periods, high-yield savings accounts provide the flexibility to access your money when needed. This balance between earning a respectable interest rate and maintaining access to your funds makes these accounts an attractive choice for anyone looking to save effectively.

In conclusion, the importance of earning 4%+ interest cannot be overstated. It is a vital component for anyone serious about their financial future. By utilizing high-yield savings accounts, you not only protect your savings from inflation but also enjoy the benefits of liquidity and ease of access. Embracing this approach to saving can lead to greater financial stability and peace of mind, all from the comfort of your home.

Chapter 2: The Basics of Interest Rates

How Interest Rates Work

Understanding interest rates is crucial for anyone looking to maximize their savings, especially when it comes to high-yield savings accounts. Interest rates determine how much money your savings can earn over time, and they fluctuate based on various economic factors. When you deposit money into a high-yield savings account, the bank pays you interest as a reward for keeping your funds with them. This interest is typically compounded, meaning you earn interest on your initial deposit as well as on the interest that accumulates over time.

Interest rates are influenced by the broader economic environment, including inflation, central bank policies, and market demand for credit. When the economy is strong, interest rates tend to rise, encouraging savings and investment. Conversely, in a weaker economy, rates may fall to stimulate borrowing and spending. Understanding this relationship helps savers anticipate changes in their account earnings and make informed decisions about where to deposit their money.

High-yield savings accounts usually offer interest rates significantly above the national average for standard savings accounts. This is primarily due to the online nature of many high-yield accounts, which have lower overhead costs compared to traditional banks. As a result, these institutions can pass on the savings to consumers in the form of higher interest rates. Savers can benefit greatly from comparing different accounts to find the ones that offer the best rates available in the market.

Compounding is another critical factor in how interest rates work. The more frequently interest is compounded, the more you will earn over time. Many high-yield savings accounts compound interest daily or monthly, allowing your savings to grow faster. By taking advantage of compounding, even small deposits can lead to substantial growth over the years, making it essential for savers to choose accounts with favorable compounding terms to maximize their earnings.

In summary, understanding how interest rates function is key for those wanting to earn 4% or more from their savings. By being aware of economic influences on interest rates, comparing high-yield accounts, and recognizing the benefits of compounding, individuals can effectively grow their money from the comfort of their homes. This knowledge empowers savers to make strategic financial choices and secure a brighter financial future without the need for complex investments or extensive financial planning.

Types of Interest: Simple vs. Compound

Understanding the types of interest is crucial for anyone looking to maximize their savings, especially when aiming for high-yield savings accounts that offer 4% or more. The two primary types of interest are simple and compound interest, each with distinct characteristics that can significantly impact your savings over time. Simple interest is calculated only on the principal amount, meaning that the interest earned does not earn interest itself. This makes it straightforward but potentially less lucrative compared to its counterpart.

On the other hand, compound interest takes the process a step further by calculating interest on both the initial principal and the accumulated interest from previous periods. This means that as your savings grow, the interest you earn also increases, creating a snowball effect. For individuals aiming to earn more from their high-yield savings accounts, understanding how compound interest works is essential. The more frequently interest is compounded, the greater the potential returns.

For instance, if you deposit $1,000 in a high-yield savings account with a 4% annual interest rate compounded monthly, you will earn more over time compared to a simple interest account with the same rate. As the months go by, the interest accrued adds to the principal, leading to a larger base amount for future interest calculations. This is why many savings accounts today emphasize the importance of compound interest, as it significantly enhances the growth of your savings.

When comparing simple and compound interest, it becomes evident that compound interest is typically the more beneficial option for long-term savers. While simple interest may be easier to understand and calculate, the advantages of compound interest make it the preferred choice for those looking to maximize their earnings. By choosing a high-yield savings account that utilizes compound interest, you can effectively grow your savings without taking any additional risks or making complex financial decisions.

In conclusion, both simple and compound interest have their places in the world of finance, but for those aiming to earn 4% or more on their savings while remaining comfortable at home, compound interest is the ideal choice. It allows your money to work harder for you, providing greater returns over time. By understanding these concepts and selecting the right savings account, anyone can achieve their financial goals without the stress of complex investment strategies.

Factors Influencing Interest Rates

Understanding the factors that influence interest rates is crucial for anyone looking to maximize their savings through high-yield accounts. Interest rates are affected by a variety of economic indicators, including inflation, the central bank’s monetary policy, and overall economic growth. When inflation rises, interest rates tend to increase as well, as lenders seek to maintain their purchasing power. This dynamic relationship means that savers must stay informed about economic trends to make the most of their savings options.

Another significant factor is the Federal Reserve’s actions. The Federal Reserve, or Fed, sets the federal funds rate, which influences how much banks can charge each other for overnight loans. When the Fed raises rates, banks typically pass on those costs to consumers in the form of higher interest rates on savings accounts. Conversely, when the Fed lowers rates, the opposite occurs, potentially leading to lower yields for savers. Therefore, understanding the Fed’s monetary policy decisions can provide valuable insight into future interest rate movements.

Additionally, market competition among banks plays a vital role in determining interest rates. In a competitive banking environment, institutions are more likely to offer attractive rates to entice customers. As online banks and fintech companies continue to emerge, they often provide higher yields than traditional banks. This competition can push interest rates up, benefiting consumers who are seeking high-yield savings accounts.

Economic growth also impacts interest rates, as stronger economic performance usually leads to higher rates. When the economy is growing, consumer spending increases, prompting banks to raise rates to accommodate the higher demand for loans. Conversely, during periods of economic downturn, interest rates may decrease as banks look to stimulate borrowing and spending. Savers should monitor economic indicators, such as GDP growth, to anticipate potential changes in interest rates.

Lastly, global economic conditions can affect interest rates in the United States. Events such as international trade agreements, geopolitical tensions, or changes in foreign economies can influence domestic interest rates. For instance, if a major trading partner experiences economic instability, it may lead to fluctuations in interest rates here at home. Staying aware of global economic trends can help savers make informed decisions about when to lock in higher interest rates on their savings accounts.

Chapter 3: Finding the Right High-Yield Savings Account

Researching Financial Institutions

Researching financial institutions is a critical step in finding the best high-yield savings accounts. With numerous banks and credit unions offering varying interest rates, it’s essential to understand the landscape before making a decision. Start by listing potential institutions that pique your interest and delve into their offerings. Look for institutions that provide clear information about their interest rates, fees, and account requirements. This initial research sets the foundation for a more informed choice.

Once you have a list of potential financial institutions, examine their interest rates closely. High-yield savings accounts typically offer rates that significantly outperform traditional savings accounts, but these rates can fluctuate. Make sure to check if the rates advertised are introductory or if they remain consistent over time. Many institutions may also have tiered rates, meaning the interest you earn can change based on your account balance. Understanding these nuances can greatly impact your savings potential.

In addition to interest rates, consider the fees associated with each account. Some institutions may charge monthly maintenance fees or impose penalties for early withdrawals. These costs can eat into your earnings, so it’s vital to choose an account with minimal or no fees. Look for promotions or offers that waive fees under certain conditions, ensuring that you maximize your savings without unnecessary deductions.

Customer service and online accessibility are also important factors to evaluate while researching financial institutions. In today’s digital world, having easy access to your account online or through a mobile app can enhance your banking experience. Read reviews to gauge customer satisfaction and look for institutions that provide support via multiple channels. A responsive customer service team can be invaluable when you have questions or encounter issues with your account.

Finally, don’t forget to assess the overall reputation and stability of the financial institutions you are considering. Look for institutions that are insured by the FDIC or NCUA, which protects your deposits up to a certain amount. Research their history, customer reviews, and any awards or recognitions they may have received. A reputable institution not only ensures your money is safe but also boosts your confidence as you save for your financial future.

Comparing Interest Rates

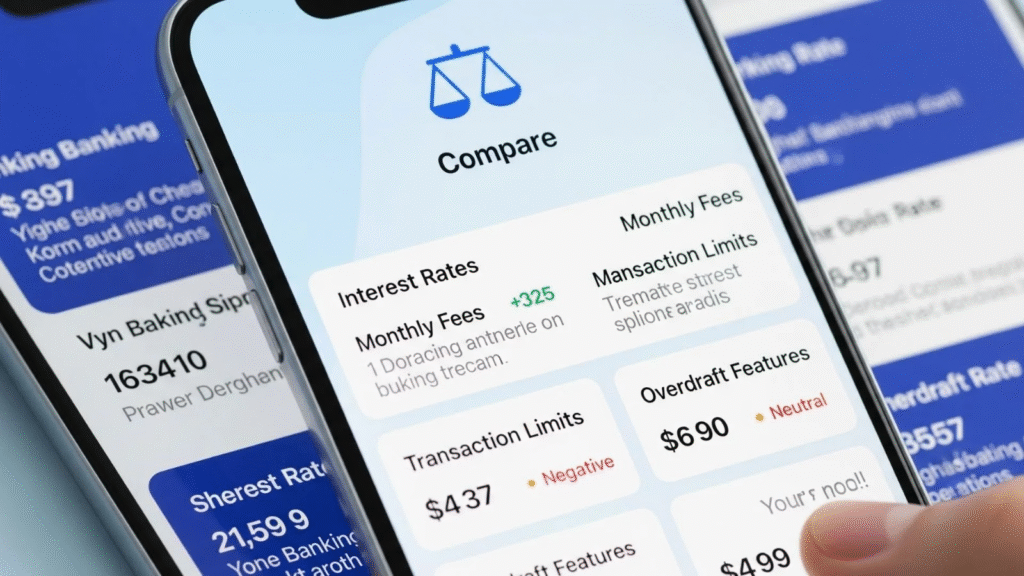

When it comes to saving money, comparing interest rates is essential for maximizing your returns. High-yield savings accounts often offer better rates than traditional savings accounts, making them an attractive option for those looking to earn more without taking on risks. Understanding how these rates work can empower you to make informed decisions about where to park your savings.

Interest rates can vary significantly between banks and credit unions, even for similar accounts. It’s important to shop around and compare offers to find the best possible rate. Many online banks provide higher rates due to lower overhead costs, which can be a great benefit for savers. By taking the time to compare rates, you can ensure that your money is working as hard as possible for you.

In addition to the interest rate itself, consider other factors such as fees, account minimums, and withdrawal restrictions. A high interest rate may not be as beneficial if the account comes with high fees that erode your earnings. Look for accounts that offer not only competitive rates but also favorable terms that align with your savings goals.

Another aspect to consider when comparing interest rates is how often the interest is compounded. Some accounts compound daily, while others do so monthly or quarterly. Daily compounding can lead to higher earnings over time, as the interest you earn begins to earn interest itself. Understanding these details can significantly impact your overall savings growth.

Finally, remember that interest rates can change frequently due to economic conditions. Keeping an eye on the market trends can help you decide when it might be a good time to switch accounts or reinvest your savings. By staying informed and proactive, you can maximize your savings potential and achieve that coveted 4%+ interest rate without ever leaving the comfort of your home.

Evaluating Fees and Minimum Balances

When considering high-yield savings accounts (HYSAs), it’s essential to evaluate the associated fees and minimum balance requirements. Many financial institutions impose various fees that can eat into your interest earnings. These fees can include monthly maintenance fees, transaction fees, and penalties for falling below a specified balance. Being aware of these potential costs will help you select an account that maximizes your savings and interest returns.

Another critical factor in evaluating high-yield savings accounts is the minimum balance requirement. Some accounts may require you to maintain a certain balance to earn the advertised interest rate or avoid fees. Understanding these requirements can help you avoid unnecessary penalties and ensure that your savings continue to grow. Look for accounts that have low or no minimum balance requirements, especially if you are just starting your savings journey.

Additionally, it is wise to compare the fees and minimum balance requirements across different financial institutions. Online banks often offer more competitive rates and fewer fees than traditional banks. By taking the time to shop around, you can find an account that not only offers a high interest rate but also aligns with your financial habits and goals.

While it may seem tedious, keeping track of the fees and minimum balance requirements is crucial for effective money management. Review your account statements regularly to ensure that you are not incurring unexpected charges. Many banks provide tools and resources to help you manage your account effectively and avoid fees, so take advantage of these offerings to stay informed.

In conclusion, evaluating fees and minimum balances is a vital step in choosing the right high-yield savings account. By understanding the costs associated with your account and selecting one that fits your financial situation, you can make the most of your savings. Remember, the goal is to earn the highest interest possible while keeping your hard-earned money accessible and secure.

Chapter 4: Setting Up Your High-Yield Savings Account

The Application Process

The application process for a high-yield savings account is straightforward and designed to be user-friendly. Most financial institutions allow you to begin the application online, which means you can complete it from the comfort of your home. You’ll need to provide some personal information, including your name, address, Social Security number, and possibly your employment information. This helps the bank verify your identity and assess your eligibility for the account.

Once you submit your application, the bank will review your information and may ask for additional documentation. This could include proof of your identity, such as a government-issued ID, or verification of your income. Many banks have streamlined this process, allowing you to upload documents directly through their website or app. This efficiency is particularly beneficial for those looking to start saving quickly.

After your application is approved, you’ll receive information on how to fund your new account. Most high-yield savings accounts require an initial deposit, which can often be done electronically via a linked bank account. Some banks may allow you to set up automatic transfers from your checking account to make saving easier. This feature not only ensures you are regularly contributing to your savings but can also help you maintain the high interest rate offered by the account.

Additionally, it’s important to review the terms and conditions before finalizing your application. Different banks offer varying interest rates, fees, and withdrawal limits. Understanding these factors will help you choose the best account for your savings goals. Take the time to compare several options to ensure you find an account that meets your financial needs and preferences.

Finally, once your account is set up and funded, the real work begins: making the most of your high-yield savings. Regularly monitor your account to stay updated on interest accrual and ensure you are not incurring unnecessary fees. By staying engaged with your account and adjusting your saving strategies as needed, you can maximize your returns and achieve your financial goals without ever needing to leave your sofa.

Required Documentation

When opening a high-yield savings account, it is essential to have the right documentation ready to ensure a smooth application process. Most financial institutions require personal identification, such as a government-issued photo ID, to verify your identity. This step is crucial for maintaining security and preventing fraud. Additionally, you may need to provide your Social Security number, which is used for tax purposes and further identity verification.

Another important document often required is proof of address. This can typically be satisfied with a recent utility bill, bank statement, or lease agreement that clearly displays your name and current address. Providing accurate information helps the bank process your application quickly and efficiently. Without this proof, your application may be delayed or even rejected, so it’s wise to have it ready beforehand.

Some banks may also require financial documentation, especially if you’re applying for an account that offers features like higher interest rates based on your savings balance. This could include recent pay stubs, tax returns, or bank statements that demonstrate your financial stability. Having this information on hand can help you qualify for the best possible account options available.

In addition to personal and financial documents, be prepared to answer questions related to your banking history. Some institutions might inquire about previous accounts, any overdrafts, or closures, as this information helps them assess your risk level as a customer. Being transparent during this process is important, as it can influence your eligibility for certain accounts.

Lastly, always read the terms and conditions associated with the high-yield savings accounts you are considering. This may involve reviewing fees, withdrawal limits, and interest rate policies. Understanding these details is crucial for making informed decisions and maximizing your savings potential. With the proper documentation and knowledge, you can confidently open a high-yield savings account and start earning interest right from the comfort of your home.

Funding Your Account

Funding your account is a crucial step in maximizing your savings potential with high-yield saving accounts. To start, you must first identify the source of funds you wish to deposit. This could be from your regular income, savings from your budget, or even a one-time bonus. Ensuring that you have sufficient funds to put into these accounts is essential, as this will directly impact the interest you can earn over time.

Once you have identified the funds, the next step is to choose the method of funding your account. Most high-yield saving accounts offer various ways to deposit money, including electronic transfers from your checking account, wire transfers, or even direct deposits from your employer. Each method has its own advantages, and selecting the right one can streamline your saving process and help you start earning interest faster.

Consider setting up an automatic transfer from your checking account to your high-yield saving account. This can be a powerful way to grow your savings without having to think about it. By automating your contributions, you ensure that a portion of your income is consistently directed toward your savings, taking advantage of compound interest over time. This strategy not only simplifies the process but also helps build a habit of saving.

It’s also important to keep an eye on the terms and conditions of your high-yield saving account. Some accounts may have minimum balance requirements or limits on the number of transactions per month. Understanding these details will help you avoid any fees that could eat into your interest earnings. Additionally, regularly reviewing your account can help you make informed decisions about increasing your funding as your financial situation changes.

Finally, don’t forget to take advantage of any promotional offers that banks may provide. Many institutions offer higher interest rates for new accounts or bonuses for opening a new high-yield saving account. By staying informed and taking advantage of these offers, you can maximize your returns and make the most out of your efforts to fund your account. In doing so, you will be well on your way to achieving your savings goals without ever leaving the comfort of your home.

Chapter 5: Strategies for Maximizing Your Savings

Setting Savings Goals

Setting savings goals is a crucial step in achieving financial stability and success. By identifying what you want to save for, you can create a roadmap that guides your savings efforts. Whether it’s an emergency fund, a vacation, or a down payment on a house, having specific goals will keep you motivated and focused on your financial journey.

To start, determine the amount you want to save for each goal. Break these amounts down into manageable monthly contributions that fit into your budget. For instance, if you’re aiming to save $3,000 for a vacation in a year, setting aside $250 each month makes the goal more approachable. This method of breaking down larger goals into smaller, achievable steps can significantly reduce stress and enhance your savings experience.

Next, consider the time frame for each goal. Short-term goals, like saving for a holiday, might require quicker access to your funds, while long-term goals, such as retirement savings, can benefit from higher-yield accounts. High-yield savings accounts are perfect for these longer-term aspirations, as they help your money grow while you work towards your goals, all from the comfort of your home.

It’s also essential to regularly review and adjust your savings goals. Life circumstances can change, and so can your financial priorities. Make it a habit to assess your goals quarterly or bi-annually, ensuring they still align with your current situation and aspirations. This flexibility will help you stay on track and make the most of your savings potential.

Finally, celebrate your achievements as you reach these milestones. Whether big or small, acknowledging your progress boosts motivation and encourages you to continue saving. By setting clear savings goals and utilizing high-yield accounts, you can enjoy a stress-free savings journey while watching your money work harder for you, all without leaving your sofa.

Automating Your Savings

In today’s fast-paced world, automating your savings can be a game changer. By setting up automatic transfers from your checking account to a high-yield savings account, you can ensure that you are consistently saving without even thinking about it. This not only helps in building your savings but also takes away the stress of manual transfers each month.

One of the first steps to automating your savings is to determine how much you want to save each month. Whether it’s a fixed amount or a percentage of your income, having a clear goal will help you stay committed. Many banks and financial institutions allow you to set up recurring transfers easily, making the process seamless and efficient.

Moreover, you can take advantage of features offered by high-yield savings accounts to maximize your interest earnings. Some accounts offer higher interest rates for maintaining a minimum balance or for setting up regular deposits. By automating your savings, you not only ensure that you’re saving consistently but also that you’re capitalizing on these benefits.

Another key aspect of automating your savings is to review and adjust your contributions periodically. Life changes, such as a new job or a change in expenses, can impact how much you can save. By regularly checking in on your savings strategy, you can make necessary adjustments to keep your savings on track.

Lastly, consider using financial apps and tools that can help you manage your automated savings effectively. Many apps offer features like goal tracking, reminders, and insights into your savings patterns. By leveraging technology, you can simplify the process and make saving a stress-free part of your financial routine.

Utilizing Multiple Accounts

Utilizing multiple accounts can be a strategic approach to maximizing your savings potential, especially when seeking high-yield savings options. By spreading your funds across several accounts, you can take advantage of different interest rates and promotional offers that various banks provide. This tactic not only diversifies your savings but also helps in managing risk, as you can secure FDIC insurance coverage up to the allowable limit for each account.

When selecting which banks to open accounts with, it’s essential to research and compare their interest rates, fees, and terms. Many online banks offer competitive rates that can easily surpass the traditional brick-and-mortar banks. By keeping an eye on promotional rates, you can switch your funds as needed to ensure that you’re always earning the highest possible interest on your savings.

Additionally, utilizing multiple accounts allows you to organize your savings for specific goals. For instance, you could have one account designated for an emergency fund, another for a vacation, and yet another for a home purchase. This method keeps your savings targeted and helps you track your progress toward each individual goal, making it easier to stay motivated and disciplined.

However, managing several accounts does require diligent tracking of each account’s activity and balance. It’s advisable to set reminders for any minimum balance requirements to avoid unnecessary fees. Utilizing budgeting apps or tools can simplify this process, allowing you to monitor all your accounts in one place, ensuring you maximize your savings without added stress.

In conclusion, utilizing multiple accounts is a viable strategy for anyone looking to earn more from their savings. By carefully selecting accounts, organizing your funds by purpose, and keeping track of your finances, you can effectively boost your interest earnings while maintaining a stress-free savings experience. Taking the time to implement this strategy can lead to significant financial growth over time, making your sofa your new best friend in managing your wealth.

Chapter 6: Understanding the Risks

Assessing Bank Safety and Security

In today’s financial landscape, assessing the safety and security of your bank is crucial for anyone looking to invest in high-yield savings accounts. The first step involves scrutinizing the bank’s insurance coverage. Most banks are insured by the Federal Deposit Insurance Corporation (FDIC), which protects your deposits up to $250,000 per individual, per account category. Understanding these protections is essential to ensuring that your hard-earned savings are safeguarded, allowing you to focus on earning interest without fear of losing your funds.

Next, it’s important to consider the bank’s financial health. Look for indicators such as the bank’s capital ratios, asset quality, and profitability. A strong financial position typically suggests a lower risk of failure, which is particularly important when choosing a bank for high-yield savings accounts. Researching the bank’s ratings from independent agencies can provide additional insights into its stability and reliability, giving you peace of mind as you invest your savings.

Another key factor in assessing bank safety is understanding the security measures in place to protect your personal and financial information. With the rise of digital banking, cybersecurity has become a paramount concern. Ensure the bank employs robust encryption methods, two-factor authentication, and other security protocols to safeguard your data. Knowing that your information is secure will help you feel more comfortable managing your high-yield savings account online.

Additionally, consider the bank’s customer service and support options. A bank that prioritizes customer satisfaction is more likely to be responsive to your needs and concerns. Look for institutions that offer multiple channels for customer support, including phone, chat, and email. Good customer service can be a lifesaver if you encounter any issues with your account or need assistance in understanding your options.

Finally, take the time to read customer reviews and testimonials. Current and former clients can provide valuable insights into their experiences with the bank, including how well the institution handles issues related to account safety and security. By gathering this information, you can make a more informed decision when selecting a bank for your high-yield savings account, ensuring that your financial future is secure while you earn 4%+ interest from the comfort of your home.

Recognizing Potential Pitfalls

When pursuing high-yield savings accounts, it’s crucial to recognize potential pitfalls that could undermine your financial goals. One common mistake is not thoroughly researching the financial institution offering the account. Many people assume that all banks and credit unions provide similar rates and services, but this is far from the truth. Understanding the credibility and reliability of the institution is foundational in ensuring your funds are safe and accessible when needed.

Another potential pitfall is overlooking the fine print associated with high-yield savings accounts. Terms and conditions can vary significantly, and it’s essential to read them carefully. For instance, some accounts may have minimum balance requirements or withdrawal limits that could affect your savings strategy. Failing to comply with these terms can lead to unexpected fees or a reduction in interest rates, negating the benefits of the higher yield.

Additionally, many savers fall into the trap of focusing solely on interest rates without considering other factors. While a 4%+ interest rate is attractive, it’s vital to evaluate how that rate compares to the overall fees and services provided. Sometimes, accounts with lower rates may offer fewer fees or better customer service, which can make them more beneficial in the long run. Balancing these factors can lead to a more rewarding savings experience.

Inflation is another critical consideration that can impact the effectiveness of high-yield savings accounts. While earning a higher interest rate is essential, it’s equally important to understand how inflation affects your purchasing power. If the inflation rate exceeds your interest earnings, your real savings may decrease over time. Keeping an eye on economic trends can help you adjust your savings strategy accordingly.

Lastly, it’s important to regularly reassess your chosen high-yield savings account. Financial offerings can change, and what was once a great rate may no longer be competitive. By routinely evaluating your account and comparing it with other options, you can ensure that you are always maximizing your savings potential. Staying informed and proactive will help you avoid pitfalls and enhance your overall financial health.

Insurance and Protection of Your Deposits

When considering high-yield savings accounts, it is essential to understand the insurance and protection of your deposits. Most reputable banks and credit unions offer Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA) insurance, which protects your funds up to a certain limit. This means that even if the financial institution were to fail, your deposits would be safe, providing you peace of mind as you aim for higher interest rates without the risk of losing your hard-earned money.

The standard insurance coverage for each depositor is $250,000 per insured bank or credit union. If you have more than that amount, it is wise to consider spreading your funds across multiple institutions to maximize your insured deposits. This strategy not only enhances your earning potential through various high-yield accounts but also ensures that all your savings remain protected under federal insurance limits.

Additionally, it is crucial to read the terms and conditions of each high-yield savings account. Some accounts may have specific withdrawal limits or fees that could affect your overall earnings. Understanding these factors ensures that you can take full advantage of the interest rates offered while maintaining the security of your funds.

Choosing a high-yield savings account with a strong reputation for stability and customer service can also provide an extra layer of security. Researching customer reviews and financial ratings can give you insight into how well the bank or credit union manages risk and protects its customers’ deposits. A trustworthy institution not only offers competitive interest rates but also prioritizes the safety and satisfaction of its customers.

In conclusion, while pursuing high-yield savings options, never overlook the importance of deposit insurance and account protection. By understanding your coverage limits, spreading your funds wisely, and selecting reputable institutions, you can enjoy the benefits of higher interest rates with the confidence that your deposits are secure. This approach allows you to focus on achieving your savings goals stress-free, knowing that your financial future is safeguarded.

Chapter 7: Monitoring and Managing Your Account

Tracking Your Interest Growth

Tracking your interest growth is a critical component of managing a high-yield savings account effectively. Understanding how your interest accumulates can provide vital insights into your saving habits and help you make better financial decisions. By keeping a close watch on your interest rates and balances, you can optimize your savings strategy and ensure that you are maximizing your earnings.

One way to track your interest growth is to regularly review your account statements. Most banks provide detailed summaries that highlight the interest earned over a specific period. By analyzing these statements, you can see the effects of different deposit amounts and the impact of compound interest on your savings. This knowledge empowers you to make informed decisions about how much to save and when to deposit funds to maximize your interest.

Additionally, consider using online tools or apps designed for monitoring savings accounts. Many financial institutions offer calculators and tracking features that allow you to simulate different savings scenarios. By inputting various deposit amounts and interest rates, you can visualize how your interest will grow over time, helping you stay motivated to reach your savings goals.

Setting specific savings goals can also enhance your interest tracking efforts. By establishing short-term and long-term financial objectives, you create a benchmark against which you can measure your progress. Regularly assessing how close you are to achieving these goals will not only keep you engaged but will also provide a clear picture of how your interest is contributing to your overall financial health.

Lastly, remember that tracking your interest growth is not just about numbers; it’s about understanding the power of saving. By cultivating a habit of regularly monitoring your account, you gain insight into your financial behavior and the benefits of compounding interest. This awareness can lead to better money management practices and ultimately help you achieve a stress-free savings experience with high yields.

Adjusting Contributions Over Time

Adjusting your contributions over time is a crucial aspect of maximizing your high-yield savings account. As financial circumstances change, whether due to a promotion, unexpected expenses, or life events, it’s important to revisit how much you are contributing. Regularly evaluating your contributions ensures that you are taking full advantage of the interest rates available to you while also aligning your savings strategy with your current financial goals.

One effective strategy is to set up automatic adjustments based on your income changes. For instance, if you receive a raise, consider allocating a percentage of that increase directly into your high-yield savings account. This way, you are constantly growing your savings without feeling the pinch of adjusting your budget. Additionally, utilizing tools such as budgeting apps can help you track your income and expenses, making it easier to determine how much you can afford to contribute.

Another important factor to consider is inflation and its impact on your savings. As the cost of living increases, maintaining the same contribution amount may not yield the same benefits. It’s wise to periodically review your savings goals and adjust your contributions accordingly to ensure that your savings keep pace with inflation. This proactive approach will help you maintain the purchasing power of your savings over time.

Moreover, keep an eye on the interest rates offered by different high-yield savings accounts. As competition increases among financial institutions, rates can fluctuate. If you notice that your current account is no longer offering competitive rates, it might be time to adjust your contributions or even switch accounts. By doing this, you can optimize the growth of your savings and ensure you are earning the best possible return.

Lastly, remember that life is unpredictable, and flexibility is key. Adjusting your contributions should not only be a response to positive financial changes but also to challenges that may arise. If you face unexpected expenses, consider temporarily reducing your contributions while still keeping some level of saving. This balance will allow you to stay on track with your financial goals without compromising your immediate needs.

Responding to Changes in Interest Rates

Interest rates are a key factor in the financial landscape, influencing both savings and investment strategies. When interest rates rise, the appeal of high-yield savings accounts becomes more pronounced, as consumers seek better returns on their money. Conversely, when rates fall, individuals may feel less motivated to keep their funds in savings accounts, opting instead for alternative investment avenues. Understanding how to respond to these changes is essential for maximizing your savings potential.

One effective strategy for responding to increasing interest rates is to regularly review and compare high-yield savings accounts. Financial institutions often adjust their rates in response to market conditions, so it pays to stay informed about the best available options. Consider switching accounts if a competitor offers significantly higher rates, ensuring that your savings are always working hard for you.

Additionally, when interest rates decline, it may be wise to re-evaluate your savings strategy. Instead of only focusing on high-yield savings accounts, you might explore other investment options such as certificates of deposit (CDs) or even low-risk bonds that could provide better returns during periods of low interest. Diversifying your savings approach can help mitigate the impact of falling rates on your overall financial health.

Another important aspect to consider is the impact of inflation on interest rates. As inflation rises, the real return on savings can diminish, even if nominal rates appear attractive. Keeping an eye on inflation trends and adjusting your savings strategy accordingly can help protect your purchasing power and ensure that your savings continue to grow in value.

Finally, staying engaged with financial news and trends will empower you to make informed decisions in response to fluctuations in interest rates. Whether it’s through newsletters, podcasts, or financial blogs, continuous learning will enhance your ability to adapt your savings strategy to changing economic conditions, ultimately leading to a more secure financial future.

Chapter 8: The Future of High-Yield Savings Accounts

Trends in the Savings Account Landscape

The landscape of savings accounts has evolved significantly in recent years, particularly with the rise of online banks and financial technology firms. Traditional banks have seen a decline in their interest rates due to low operational costs and increasing competition from digital platforms. This shift has made high-yield savings accounts more accessible and appealing to consumers who are seeking better returns on their savings without the need for complex investment strategies. As a result, individuals are increasingly turning to these accounts for their savings needs.

One of the most notable trends in the savings account landscape is the growing popularity of high-yield savings accounts that offer interest rates of 4% or more. These accounts are typically offered by online banks that have lower overhead costs compared to brick-and-mortar institutions. This allows them to pass on the savings to consumers in the form of higher interest rates. As more people become aware of these options, the demand for high-yield accounts is expected to continue to rise, giving consumers more power in their financial decisions.

Another significant trend is the increasing emphasis on digital banking features that enhance user experience. Many high-yield savings accounts now come with mobile apps that allow customers to easily manage their funds, track their savings goals, and make transactions from the comfort of their homes. This convenience is particularly appealing to tech-savvy consumers who prioritize ease of access and functionality in their financial products. Furthermore, the integration of budgeting tools and financial education resources within these apps is making it easier for users to make informed decisions about their savings.

Additionally, as consumers become more environmentally conscious, there is a growing demand for banks that prioritize sustainability. Some financial institutions are now aligning themselves with eco-friendly practices, such as investing in renewable energy projects or offering incentives for environmentally responsible behavior. This trend reflects a broader societal shift towards sustainability and responsible banking, appealing to consumers who wish to make a positive impact with their savings.

In conclusion, the trends in the savings account landscape are shaping the way individuals approach their savings. With the availability of high-yield savings accounts, enhanced digital experiences, and an emphasis on sustainability, consumers are better positioned than ever to achieve their financial goals. As the market continues to evolve, it remains essential for individuals to stay informed and take advantage of the opportunities available to them, ensuring they can earn the best possible returns on their savings.

Potential Changes in Interest Rates

Interest rates play a pivotal role in the financial landscape, influencing not only borrowing costs but also the returns on savings accounts. In recent years, the fluctuations in interest rates have prompted many individuals to seek out high-yield savings accounts that promise a return of 4% or more. Understanding potential changes in interest rates is essential for savers who want to maximize their earnings while minimizing risk. This knowledge empowers individuals to make informed decisions about where to park their funds and how to grow their wealth effectively.

The Federal Reserve’s monetary policy significantly impacts interest rates across the board. When the Fed raises or lowers rates, it creates a ripple effect through banks and financial institutions, which adjust their rates accordingly. For those looking to earn high yields, this means staying informed about the Fed’s actions and economic indicators that signal potential shifts. A proactive approach to understanding these factors can help savers seize opportunities when rates rise and protect their interests when rates fall.

Economic conditions such as inflation, employment rates, and consumer spending also influence interest rates. For instance, higher inflation may prompt the Fed to increase rates to maintain purchasing power and stabilize the economy. Conversely, during periods of recession, rates may be lowered to encourage borrowing and spending. For individuals invested in high-yield savings accounts, recognizing these economic trends can provide insight into when to lock in rates or explore alternative savings options.

Additionally, competition among banks for depositors’ money affects interest rates offered on savings accounts. Financial institutions are keen to attract customers with enticing rates, especially during times of economic growth. As a result, savvy savers should regularly compare rates from various banks to ensure they are getting the best returns on their investments. This vigilance can lead to significant gains over time, particularly when interest rates are on the rise.

In conclusion, staying attuned to potential changes in interest rates is crucial for anyone looking to maximize their savings. By understanding the factors that influence these rates and actively managing their savings strategies, individuals can secure high-yield accounts that meet their financial goals. The landscape of interest rates is ever-changing, but with the right knowledge and tools, achieving 4%+ interest from the comfort of home is entirely possible.

Preparing for Economic Shifts

In today’s rapidly changing economic landscape, preparing for financial shifts is crucial for individuals seeking to maximize their savings. Understanding the factors that influence interest rates and savings accounts can equip you with the knowledge to make informed decisions. With the right strategies, you can ensure your high-yield savings account continues to work for you, regardless of external economic pressures.

One of the key aspects of preparing for economic shifts is staying informed about current trends and forecasts. Keeping an eye on economic indicators such as inflation rates, employment figures, and central bank policies can provide insight into potential changes in interest rates. By being proactive and aware, you can adjust your savings strategy accordingly to maintain or even enhance your earnings.

Another important strategy is diversifying your savings options. While high-yield savings accounts offer attractive interest rates, it’s wise to explore other financial products as well. Certificates of deposit (CDs), money market accounts, and even low-risk investments can serve as effective complements to your savings strategy, allowing you to maximize your returns during various economic conditions.

Additionally, consider setting aside an emergency fund that can cover unexpected expenses. This financial cushion not only provides peace of mind but also allows you to avoid dipping into your high-yield savings account when emergencies arise. Maintaining this separation ensures that your savings continue to grow while you manage life’s uncertainties with confidence.

Lastly, regularly reviewing your financial goals and savings performance is essential. As economic conditions evolve, so should your approach to saving and investing. Take the time to assess your high-yield savings account’s performance and make adjustments as needed, ensuring that your financial strategy remains aligned with your goals and the current economic climate.

Chapter 9: Conclusion and Next Steps

Recap of Key Takeaways

In this recap of key takeaways, we emphasize the importance of high-yield savings accounts for individuals looking to maximize their interest earnings without the need for extensive financial knowledge or effort. These accounts provide an accessible way for anyone to earn rates of 4% or higher, making savings more rewarding than traditional options.

One of the critical points discussed is the concept of compounding interest, which allows your savings to grow exponentially over time. By understanding how this works in high-yield accounts, individuals can make informed decisions about their saving strategies. It’s essential to start saving early and consistently to take full advantage of these benefits.

Another vital takeaway is the necessity of comparing different high-yield savings accounts before committing to one. Factors such as interest rates, fees, and accessibility should be scrutinized to ensure that the chosen account aligns with your financial goals. This diligence can lead to better returns on your hard-earned money.

Additionally, we explored the convenience of managing high-yield savings accounts from the comfort of your home. Online banking has revolutionized the way people handle their finances, making it easier to monitor accounts and perform transactions without the need for physical visits to a bank. This accessibility encourages more people to save and earn higher interest without added stress.

Finally, we highlighted the significance of setting clear financial goals. Whether it’s saving for a vacation, a home, or retirement, having a target can motivate individuals to prioritize their savings. By utilizing high-yield savings accounts effectively, anyone can work towards achieving their financial aspirations while enjoying the benefits of substantial interest gains.

Making Informed Decisions

Making informed decisions about high-yield savings accounts can significantly impact your financial health. With numerous options available, it is crucial to compare interest rates, fees, and account features. Understanding how these elements affect your savings can empower you to choose an account that aligns with your financial goals. It is not just about the highest interest rate; it’s about the overall value the account offers.

Research plays a vital role in making informed choices. Start by gathering data on various financial institutions that provide high-yield savings accounts. Look for reputable sources that compare rates and terms. Additionally, consider reading customer reviews to gauge the level of service provided by these institutions. This information will equip you with the knowledge necessary to make sound decisions.

Another key factor in decision-making is understanding the terms and conditions associated with each account. Some accounts may offer enticing interest rates but come with hidden fees or minimum balance requirements. Make sure to read the fine print and understand any potential penalties for withdrawals or account maintenance. This diligence will help you avoid pitfalls that could diminish your savings.

It is also important to evaluate your own financial situation and goals. Determine how much you plan to save and how frequently you will deposit funds into your account. This self-assessment can guide you in choosing the right account type that not only provides a competitive interest rate but also accommodates your saving habits. Tailoring your choice to your personal circumstances can lead to more effective saving strategies.

Ultimately, making informed decisions is about balancing risk and reward. High-yield savings accounts can provide an excellent opportunity to grow your savings with minimal risk. By carefully evaluating your options and understanding the implications of your choices, you can maximize your savings potential while enjoying the convenience of managing your finances from home.

Taking Action for Stress-Free Savings

Taking action for stress-free savings begins with understanding what high-yield savings accounts can offer. These accounts are specifically designed to provide better interest rates than traditional savings accounts, allowing your money to grow more effectively while you maintain easy access to it. By taking the time to research and compare different high-yield savings options, you can find an account that suits your financial goals and lifestyle. This initial step is crucial in building a solid foundation for your savings strategy.

Once you’ve identified a high-yield savings account that meets your needs, the next step is to set up automatic transfers. Automating your savings not only reduces the temptation to spend but also ensures that you consistently put money aside. By treating your savings like a regular expense, you can effortlessly increase your savings balance over time. This proactive approach allows you to build a cushion for emergencies or future investments without the stress of manual transfers.

Additionally, it’s important to review your financial habits regularly. Analyze your spending patterns and identify areas where you can cut back. This doesn’t mean sacrificing enjoyment or comfort, but rather finding ways to optimize your budget. By reallocating funds that would otherwise be spent on non-essentials into your high-yield savings account, you can maximize your interest earnings while minimizing financial strain.

Another effective strategy for stress-free savings is to take advantage of promotional offers from banks and credit unions. Many institutions offer bonuses for opening new high-yield savings accounts or meeting certain deposit thresholds. By staying informed about these promotions, you can make your money work even harder for you. Keep an eye on the terms and conditions to ensure you meet any requirements for earning these bonuses, further enhancing your savings potential.

Lastly, stay committed to your savings goals by tracking your progress. Regularly check your account balance and interest accrued, which can motivate you to save even more. Consider setting specific savings milestones to celebrate, such as reaching a certain balance or saving a specific amount in a set timeframe. This not only keeps you engaged but also reinforces the benefits of high-yield saving accounts, making the entire process of saving less stressful and more rewarding.