Finding affordable car insurance isn’t about luck; it’s about being a smart shopper. While many drivers believe that securing the cheapest auto insurance means settling for minimal coverage, savvy consumers know better. It’s entirely possible to find policies that offer full protection—including comprehensive and collision coverage—at a price that fits your budget. The key lies in knowing how to effectively compare auto insurance quotes and identify true value. This article will equip you with the essential tips to reduce your premiums while maintaining the robust coverage you and your vehicle deserve.

Chapter 1: Understanding Auto Insurance

The Basics of Auto Insurance

Auto insurance is a critical aspect of vehicle ownership that protects drivers financially in the event of accidents, theft, or other damages. Understanding the basics of auto insurance is essential for anyone seeking to secure the most affordable rates without sacrificing necessary coverage. At its core, auto insurance is a contract between the policyholder and the insurance company, where the insurer agrees to provide financial protection in exchange for regular premium payments. Knowing how these policies work can help individuals make informed choices when shopping for quotes.

There are several types of coverage included in auto insurance policies, each serving a specific purpose. Liability coverage is often required by law and covers damages to other people and property if the insured driver is at fault in an accident. Collision coverage pays for damage to the insured vehicle resulting from a collision, while comprehensive coverage protects against non-collision-related incidents, such as theft or natural disasters. Understanding these coverage types is crucial for selecting the right policy that meets individual needs without overspending.

Shopping for auto insurance quotes can seem overwhelming, but there are strategies to simplify the process. Start by gathering quotes from multiple insurance providers to compare rates and coverage options. Online comparison tools can be particularly helpful in this regard. It’s important to assess the coverage limits and deductibles associated with each quote, as these factors can significantly impact overall insurance costs. Make sure to inquire about any discounts available, such as safe driver discounts or multi-policy savings, which can further reduce premiums.

Another key aspect to consider is the importance of maintaining a good driving record. Insurance companies often evaluate a driver’s history when determining rates, with safer drivers typically receiving lower premiums. Additionally, factors such as credit scores and the type of vehicle driven can also influence insurance rates. Understanding these variables allows individuals to work towards improving their rates over time, making it possible to find affordable quotes without compromising on necessary protection.

In conclusion, grasping the basics of auto insurance is vital for anyone seeking to navigate the often complex landscape of auto insurance quotes. By understanding the different types of coverage, shopping strategically, and considering personal factors that affect rates, individuals can secure the best possible auto insurance deals. Ultimately, the goal is to find a balance between cost and coverage, ensuring that you are well protected on the road while saving money on your premiums.

Types of Coverage

Understanding the various types of coverage available in auto insurance is essential for getting the best protection without overspending. Auto insurance can be categorized into several types, including liability, collision, and comprehensive coverage. Each type serves a different purpose, and knowing how they work can help you make informed decisions when shopping for quotes.

Liability coverage is one of the most basic and required types of auto insurance. It covers damages to other people’s property and medical expenses if you are found at fault in an accident. This type of coverage is crucial for protecting your assets and ensuring that you meet state minimum requirements. However, it does not cover your own vehicle or injuries, which is where other types of coverage come into play.

Collision coverage is specifically designed to cover damages to your vehicle resulting from a collision with another car or object. This type of insurance pays for repairs or replacement of your vehicle, regardless of who caused the accident. For individuals who drive newer or high-value vehicles, having collision coverage can be a smart choice, as it helps maintain the vehicle’s value and minimizes out-of-pocket expenses in the event of an accident.

Comprehensive coverage goes beyond collision and covers damages to your vehicle that are not the result of a collision. This includes incidents such as theft, vandalism, natural disasters, and animal collisions. While comprehensive coverage is not always mandatory, it can be particularly beneficial for those living in areas prone to such risks, offering peace of mind and financial protection from unexpected events.

Finally, it’s important to consider additional coverages like personal injury protection (PIP) and uninsured/underinsured motorist coverage. PIP helps cover medical expenses for you and your passengers, regardless of fault, while uninsured/underinsured motorist coverage protects you when involved in accidents with drivers who do not have sufficient insurance. Understanding these types of coverage will enable you to secure the cheapest auto insurance quotes while ensuring you do not overlook essential protections.

Importance of Having Insurance

Having auto insurance is essential for protecting yourself financially in the event of an accident. It serves as a safety net that covers damages to your vehicle, medical expenses, and liability costs associated with any accidents you may cause. Without insurance, the financial burden of these expenses can be overwhelming and may lead to significant financial hardship.

One of the key reasons to have auto insurance is the peace of mind it provides. Knowing that you are covered in case of an unforeseen incident allows you to drive with confidence. This peace of mind extends beyond just the driver; it also reassures passengers and other road users that you are responsible and prepared.

Moreover, many states require drivers to carry a minimum amount of insurance. Failing to have adequate coverage can result in hefty fines and legal penalties. This legal obligation highlights the importance of being proactive in securing the right insurance policy that meets both state requirements and personal needs.

Additionally, insurance can protect your investment in your vehicle. Cars can be expensive, and having the right coverage can help you recover the costs of repairs or replacement in the event of theft or a severe accident. This financial protection is crucial for maintaining the value of your vehicle over time.

In conclusion, the importance of having auto insurance cannot be overstated. It is not merely a legal requirement but a vital component of responsible driving. Securing the right policy ensures that you can navigate the roads confidently, knowing that you are protected against potential financial losses while being compliant with the law.

Chapter 2: The Cost of Auto Insurance

Factors Influencing Premiums

When considering auto insurance premiums, several factors come into play that can significantly influence the cost. One of the primary determinants is the driver’s history, including their record of accidents and traffic violations. Insurers often assess the risk associated with a driver based on past behavior, leading to higher premiums for those with a rocky driving history. Furthermore, age and gender can play a role, as younger drivers and male drivers often face higher rates due to statistical trends indicating they are more likely to be involved in accidents.

Another critical factor affecting insurance premiums is the type of vehicle being insured. Cars with higher safety ratings or those that are less likely to be stolen typically attract lower premiums. Conversely, high-performance vehicles or luxury cars can lead to increased costs due to their higher repair and replacement values. Insurers evaluate the risk associated with the vehicle itself, including its safety features and claims history, which can vary significantly between different makes and models.

Location is also a significant factor influencing auto insurance premiums. Drivers living in urban areas may experience higher rates due to increased traffic congestion, higher crime rates, and a greater likelihood of accidents. In contrast, rural drivers often enjoy lower premiums because they face fewer risks associated with densely populated areas. Insurers analyze regional data to determine how location impacts the risk of claims, which ultimately affects the premiums charged.

Additionally, the coverage levels selected by the policyholder will influence the premiums. Comprehensive coverage, which includes a wider range of protections, typically results in higher costs compared to basic liability coverage. Drivers must carefully consider their coverage needs and balance them against their budget to find the right policy that provides adequate protection without excessive premiums. Understanding the trade-offs between different coverage options can be crucial in securing the best rates.

Lastly, the credit score of the driver can also affect insurance premiums. Many insurers use credit information as a factor in determining risk; a higher credit score often correlates with lower premiums. This practice has sparked some debate, but it remains a common underwriting criterion. Drivers looking to reduce their premiums may consider improving their credit score as part of their overall strategy for finding affordable auto insurance quotes while ensuring they maintain sufficient coverage.

Understanding Deductibles

Understanding deductibles is crucial for anyone looking to save money on auto insurance while ensuring they have adequate coverage. A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in. For example, if you have a $500 deductible and incur $2,000 in damages, you would pay the first $500, and your insurance would cover the remaining $1,500. This mechanism can significantly impact your overall insurance costs.

Choosing the right deductible involves balancing your financial situation with your insurance needs. Higher deductibles typically result in lower premiums, which can be appealing if you’re aiming to find the cheapest rates. However, it’s essential to consider whether you can comfortably afford to pay that higher amount in the event of a claim. This decision should be based on your financial stability and your driving habits.

Another important aspect to understand is how deductibles can vary based on the type of coverage you select. For instance, collision and comprehensive coverage often have different deductible options. It may be tempting to opt for a higher deductible to lower your premium, but it’s vital to evaluate how this choice aligns with your risk tolerance and potential out-of-pocket expenses after an accident.

Many drivers overlook the impact of deductibles when comparing auto insurance quotes. Insurers often provide different deductible options at various price points, and this can significantly affect your overall insurance costs. By carefully comparing these options, you can ensure that you’re not only getting the cheapest rate but also maintaining the coverage that best suits your needs.

In conclusion, understanding deductibles is a key component of making informed decisions about auto insurance. By evaluating the deductibles offered in relation to your financial situation and coverage needs, you can find a balance that minimizes your expenses while protecting yourself on the road. This knowledge empowers you to select policies that provide the best overall value without leaving you underinsured.

Comparing Costs Across Providers

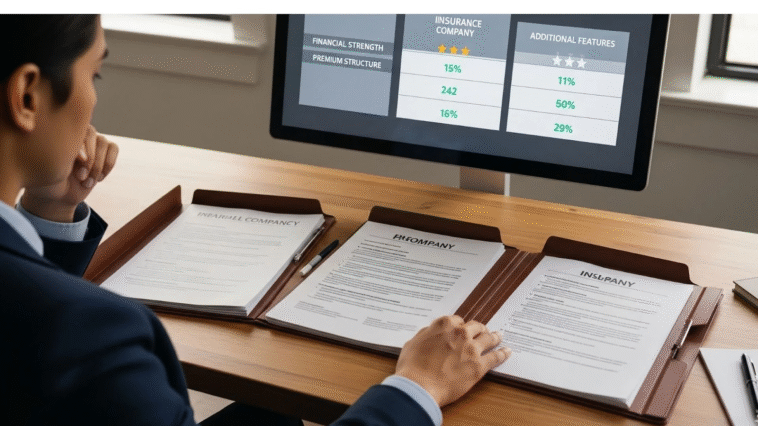

When it comes to auto insurance, comparing costs across different providers is essential for finding the best deal. Each insurance company has its own pricing structure, which can vary significantly based on various factors such as coverage options, deductibles, and individual driver profiles. Therefore, taking the time to gather quotes from multiple providers can lead to substantial savings while ensuring adequate coverage. It’s important to approach this process methodically by considering both the premiums and the coverage offered by each provider.

One of the first steps in comparing auto insurance providers is to obtain quotes from at least three to five different companies. Online comparison tools can be particularly useful for this, as they allow users to input their information once and receive multiple quotes at once. However, it’s crucial to ensure that the coverage limits and deductibles are consistent across all quotes to make a fair comparison. A lower premium might not be the best option if it comes with significantly reduced coverage.

In addition to premiums, examining the financial stability and customer service reputation of each insurance provider is vital. A company with the lowest rate might not be worth the risk if it has a history of poor claims handling or customer dissatisfaction. Researching customer reviews and ratings from independent agencies can provide valuable insight into the reliability and reputation of each provider. This evaluation will help ensure that you are not only choosing the cheapest option but also a company that will provide quality service when it matters most.

Another essential aspect to consider when comparing costs is the various discounts that providers offer. Many insurance companies provide discounts for good driving records, bundling policies, or even for being a member of certain organizations. Identifying these discounts can significantly affect the final premium. Therefore, it’s wise to ask each provider about available discounts and how they can impact your overall costs.

Ultimately, the goal of comparing costs across auto insurance providers is to find a balance between affordable premiums and comprehensive coverage. By being diligent in gathering quotes, assessing the reputation of providers, and considering available discounts, consumers can make informed decisions. This process not only leads to savings but also ensures that drivers are adequately protected on the road.

Chapter 3: The Importance of Quotes

What is an Insurance Quote?

An insurance quote is a crucial element in the process of selecting auto insurance. It provides potential policyholders with an estimate of how much they will pay for coverage based on various factors. These factors typically include the driver’s age, driving history, the type of vehicle, and the coverage options selected. Understanding what an insurance quote entails can help consumers make informed decisions and find the best deals in the market.

When obtaining an insurance quote, individuals may provide their personal information, including their address and details about their vehicle. Insurers will use this data to assess risk and determine premium rates. The quote can vary significantly among different providers, which is why shopping around is essential. By comparing quotes, consumers can identify not only the most affordable options but also ensure they do not compromise on essential coverage.

Quotes can be obtained online, over the phone, or through insurance agents, making it convenient for consumers to gather information. Many insurance companies offer free quotes, allowing individuals to explore their options without any financial commitment. This accessibility encourages individuals to take their time in assessing the coverage that best fits their needs and budget.

It is important to note that a quote is not a binding agreement. It serves as an estimate, and the final premium may change based on further underwriting assessments. Factors such as credit history, potential discounts, and additional drivers can influence the final cost. Therefore, consumers should be prepared for variations between the initial quote received and the final premium that is ultimately offered.

In summary, an insurance quote is an invaluable tool for anyone seeking auto insurance. It not only provides a snapshot of potential costs but also highlights the importance of comparing different options to secure both affordability and comprehensive coverage. By understanding the intricacies of insurance quotes, consumers can navigate the often-complex world of auto insurance with greater confidence and clarity.

How to Obtain Quotes

Obtaining auto insurance quotes is an essential step for anyone looking to secure the best coverage at the most affordable price. The first step in this process is to gather information about your vehicle and personal details that insurers typically require. This includes your car’s make, model, year, and Vehicle Identification Number (VIN), along with your driving history, including any accidents or violations. Having this information handy will streamline the quoting process and ensure accuracy in the estimates you receive.

Next, it’s vital to shop around for quotes from multiple insurance providers. Online comparison tools can be incredibly beneficial, as they allow you to enter your information once and receive quotes from various companies simultaneously. This not only saves time but also helps you identify the most competitive rates available. Remember to check both national insurers and local companies, as regional providers may offer better deals that cater to your specific needs.

When comparing quotes, pay close attention to the coverage options included in each policy. The cheapest option may not always be the best choice if it lacks essential coverage elements. Make sure to evaluate the details of each quote, focusing on liability limits, deductibles, and any additional coverage options such as collision or comprehensive insurance. Understanding what you are paying for ensures that you do not compromise protection for lower premiums.

Additionally, consider reaching out directly to insurance agents for personalized quotes. Agents can provide insights and recommendations based on your specific situation, which can lead to better coverage options tailored to your needs. They may also have access to discounts or packages that are not readily available online, giving you the opportunity to save even more.

Finally, don’t forget to review and reassess your quotes periodically. Insurance rates can change due to various factors, including changes in your driving record, mileage, and even the market conditions. Regularly obtaining quotes will keep you informed of your options and allow you to switch providers if necessary, ensuring that you always have the best possible coverage at the lowest rate.

The Value of Multiple Quotes

When it comes to auto insurance, obtaining multiple quotes can significantly impact the cost of your premium. Each insurance company has its own algorithms and criteria for determining risk, which means that the same coverage can be priced differently across various providers. By gathering multiple quotes, consumers can compare these prices and find the most economical option without sacrificing essential coverage. This process ensures that you are not only looking for the lowest rate but also considering the quality of coverage being offered.

In addition to financial savings, multiple quotes provide a more comprehensive understanding of the different policy options available. Different insurers may offer unique add-ons or discounts that can enhance your coverage at a similar price point. Exploring these variations can help you tailor a policy that best fits your specific needs, ensuring that you are adequately protected on the road. This approach empowers you to make informed decisions based on a variety of factors rather than just the premium amount.

Moreover, obtaining multiple quotes can help you identify any hidden costs or exclusions in a policy that might not be apparent at first glance. Some insurance companies may present a low premium but include higher deductibles or limited coverage options that could lead to higher out-of-pocket expenses in the event of a claim. By comparing multiple quotes, you can discern these discrepancies and choose a policy that offers genuine value rather than a misleadingly low rate.

The value of multiple quotes extends beyond just financial aspects; it also fosters a sense of confidence when selecting an insurance provider. When you have done your research and compared various options, you are more likely to feel secure in your choice. This reassurance is essential, especially when it comes to something as crucial as auto insurance, where the right coverage can make a significant difference in times of need. A well-informed decision not only saves money but also provides peace of mind.

Lastly, many online platforms facilitate the process of obtaining multiple quotes effortlessly. These tools allow consumers to input their information once and receive quotes from several insurers in minutes. This convenience eliminates the hassle of contacting each company individually, making it easier for consumers to take control of their auto insurance needs. Utilizing technology in this way can lead to better savings and more tailored coverage options, ultimately enhancing the overall experience of purchasing auto insurance.

Chapter 4: Finding the Cheapest Quotes

Online Tools and Resources

In today’s digital age, online tools and resources have revolutionized the way consumers shop for auto insurance. With just a few clicks, individuals can access a plethora of websites designed to compare quotes from various insurers. These tools not only simplify the process but also empower consumers to make informed decisions based on their specific needs. By utilizing these resources, potential policyholders can find the best rates without compromising on essential coverage features.

One of the most effective ways to use online tools is through comparison websites. These platforms allow users to input their information once and receive multiple quotes from different insurance providers. This side-by-side comparison helps consumers identify which policies offer the best value for their money. Additionally, many comparison sites provide user reviews and ratings, giving insight into the customer service and claims process of each insurer.

Another valuable resource is the use of auto insurance calculators available on many insurance company websites. These calculators help individuals estimate their potential premiums based on factors such as driving history, location, and vehicle type. By providing tailored estimates, these tools can guide users in selecting coverage levels that not only fit their budgets but also meet their protection needs. Understanding these calculations can lead to more educated choices when finalizing an insurance policy.

Furthermore, online forums and communities can serve as excellent resources for those seeking advice on auto insurance. Engaging in discussions with other consumers who have recently navigated the insurance landscape can provide insights that are not readily available through formal channels. These platforms often feature personal experiences and tips that can help individuals avoid common pitfalls and find the best deals available in their area.

Finally, it is important to stay informed about the latest trends and changes in the auto insurance market. Many insurance blogs and websites offer articles, news updates, and expert advice on navigating insurance options effectively. By regularly visiting these resources, consumers can remain aware of new policies, discounts, and other opportunities that may arise, ensuring they always secure the best rates while maintaining comprehensive coverage.

Local Agents vs. Online Quotes

When it comes to obtaining auto insurance quotes, individuals often find themselves weighing the pros and cons of local agents versus online quotes. Local agents provide a personal touch, allowing customers to build relationships and receive tailored advice based on their unique circumstances. This face-to-face interaction can lead to a deeper understanding of coverage options and the nuances of policies, which is particularly valuable for first-time insurance buyers or those with complex needs.

On the other hand, online quotes have revolutionized the way consumers shop for auto insurance. They offer the convenience of obtaining multiple quotes from various insurers within minutes, allowing potential policyholders to compare prices and coverage options with ease. This method is particularly appealing for those who prefer to conduct research at their own pace, without the pressure of a sales pitch from an agent.

However, the choice between local agents and online quotes often depends on individual preferences and circumstances. For those who prioritize personalized service and detailed explanations, a local agent may be the better choice. Conversely, tech-savvy consumers who are comfortable navigating online platforms might find that online quotes save them both time and money, leading to more competitive rates.

Moreover, some insurance companies offer hybrid models that combine both approaches, allowing customers to start their quote online and then consult with a local agent for further assistance. This flexibility can help bridge the gap between personal service and the efficiency of online tools, ensuring that consumers receive the best of both worlds. It also underscores the importance of understanding one’s own needs when selecting an insurance provider.

Ultimately, whether one opts for a local agent or online quotes, the key lies in making informed decisions. Careful consideration of the benefits and drawbacks of each option can lead to significant savings while still maintaining adequate coverage. By exploring both avenues, consumers can ensure they are not only getting the cheapest rates but also the protection they need on the road.

Timing Your Quotes for Best Rates

Timing your quotes is crucial when seeking the best rates for auto insurance. Many consumers are unaware that the time of year can significantly influence the pricing of insurance premiums. For example, rates may be lower during certain months due to less demand, such as during the winter season when fewer accidents typically occur. By understanding these seasonal trends, you can strategically time your quotes to secure the most favorable rates.

Another important factor to consider is your personal circumstances and how they align with the insurance market’s fluctuations. If you have recently made changes in your life, such as moving, purchasing a new vehicle, or even changing your job, it may be an excellent time to shop for quotes. Insurance companies often assess risk based on updated information, and a change in your situation might make you eligible for discounts or better rates that weren’t available before.

In addition to seasonal timing, consider the day of the week you request your quotes. Research suggests that rates can vary depending on the day; for instance, quotes received at the beginning of the week may be more competitive than those received at the end. Insurance companies may adjust their pricing strategies based on their weekly sales goals or the number of new policies they need to issue, so timing your inquiries can play a significant role in your overall savings.

Utilizing technology can enhance your ability to time your quotes effectively. Many websites and apps allow you to compare rates from multiple insurers simultaneously. By setting alerts for price drops or promotions, you can ensure that you are ready to act when the best rates become available. This proactive approach can help you save both time and money, allowing you to focus on other important aspects of your life while still getting the best protection for your vehicle.

Finally, always remember to review your quotes regularly, even after you’ve purchased a policy. The insurance market is dynamic, and new discounts or changes in rates can occur at any time. By staying informed and timing your next round of quotes strategically, you can ensure that you are always getting the best possible rates without sacrificing coverage. This ongoing diligence will empower you to make smarter financial decisions in the long run.

Chapter 5: Balancing Cost and Coverage

Understanding Minimum Coverage Requirements

Understanding minimum coverage requirements is essential for anyone looking to purchase auto insurance. Each state has its own set of regulations that dictate the minimum amount of coverage drivers must carry. These requirements are designed to protect not only the driver but also other parties involved in an accident. Failing to meet these minimums can result in significant penalties, including fines and the suspension of driving privileges.

The most common types of minimum coverage include liability insurance, which covers damages to other vehicles and medical expenses for injuries caused by the insured driver. Additionally, many states require uninsured and underinsured motorist coverage. This type of insurance provides protection if the other driver lacks sufficient coverage to pay for damages, ensuring that you are not left to bear the financial burden alone.

While meeting minimum coverage is necessary, it is often not enough to ensure comprehensive protection. Many drivers opt for additional coverage options, such as collision and comprehensive insurance, to safeguard against theft, vandalism, and damage from accidents. Evaluating your personal financial situation and driving habits can help determine if these additional options are worth the investment.

It is also crucial to understand how minimum coverage requirements can impact your auto insurance quotes. Insurers consider your coverage levels when calculating premiums, and opting for the minimum may lead to lower upfront costs. However, this choice could result in higher out-of-pocket expenses in the event of an accident, which is a critical factor to weigh when seeking the cheapest rates without sacrificing essential protection.

In conclusion, understanding minimum coverage requirements is a vital step in the auto insurance purchasing process. By familiarizing yourself with your state’s laws and considering your individual needs, you can make informed decisions that balance affordability with adequate protection. This knowledge will empower you to find the best auto insurance quotes that meet both your budget and coverage needs.

Evaluating Additional Coverage Options

When evaluating additional coverage options for auto insurance, it’s essential to understand the different types available and how they can protect you beyond standard liability coverage. Many drivers are unaware of the additional coverages that can provide extra layers of security, such as comprehensive and collision coverage. These options can help cover damages to your vehicle in various situations, including theft, vandalism, or accidents involving other vehicles. By exploring these options, you can make informed decisions that align with your financial situation and risk tolerance.

Another important aspect to consider is uninsured and underinsured motorist coverage. This type of insurance can be crucial if you find yourself in an accident with a driver who lacks sufficient coverage to pay for damages. It ensures that you are protected against potential financial losses, offering peace of mind when on the road. Evaluating your current insurance policy and considering adding this coverage can safeguard you from unforeseen circumstances that could lead to significant out-of-pocket expenses.

Personal injury protection (PIP) is another valuable coverage option to evaluate. It can help cover medical expenses, lost wages, and other related costs that may arise from an accident, regardless of who is at fault. This can be especially beneficial for those who rely on their vehicle for work or have family members who often ride with them. By assessing your needs and potential medical costs, you can determine if PIP is a necessary addition to your insurance policy.

Additionally, consider looking into roadside assistance and rental car reimbursement options. Roadside assistance can be a lifesaver if you experience car trouble, providing services such as towing, tire changes, and fuel delivery. Rental car reimbursement ensures that you have a vehicle while your car is being repaired after an accident. Evaluating these options can enhance your overall driving experience and reduce stress during unforeseen circumstances.

Ultimately, the key to finding the cheapest auto insurance quotes without skipping coverage lies in thorough research and understanding your needs. By evaluating additional coverage options, you can build a comprehensive policy that protects you effectively while also fitting your budget. Engaging with different insurance providers to compare quotes and coverage options can lead you to a better deal that offers both affordability and sufficient protection for your vehicle.

The Risks of Underinsurance

Underinsurance poses significant risks for individuals who opt for minimal coverage to save on auto insurance premiums. While it may seem cost-effective in the short term, the potential financial repercussions from an accident can be devastating. Many drivers underestimate the true costs associated with vehicle repairs, medical bills, and legal fees that can arise from even minor collisions. When the coverage limits are insufficient, policyholders may find themselves facing out-of-pocket expenses that could have been avoided with a more comprehensive policy.

One of the primary dangers of underinsurance is the financial burden placed on the insured after an accident. If a driver is involved in a collision and their insurance does not cover the full extent of the damages, they may be responsible for paying the difference. This can quickly escalate into a significant financial crisis, especially if they are also dealing with injuries or other complications from the accident. The stress of managing these expenses can lead to long-term financial instability, making it imperative to choose coverage wisely.

Moreover, underinsurance can result in legal consequences. In many states, drivers are required to carry a minimum level of insurance, and failing to meet these requirements can lead to penalties, including fines and potential loss of driving privileges. If an underinsured driver is at fault in an accident, they may face lawsuits from the other party, further complicating their financial situation. This can result in not only additional costs but also damage to their credit score and future insurability.

The emotional toll of being underinsured should not be overlooked. In the aftermath of an accident, the anxiety of financial liability can weigh heavily on individuals, impacting their overall well-being and peace of mind. Knowing that one is inadequately protected can lead to constant stress and worry, which may affect personal and professional relationships. In contrast, having the right level of coverage allows individuals to drive with confidence, knowing they are protected against unforeseen circumstances.

In conclusion, while the temptation to save money by opting for minimal auto insurance coverage might be strong, the risks associated with underinsurance far outweigh the immediate financial benefits. It is crucial for drivers to evaluate their individual needs and the potential risks they face on the road. By investing in comprehensive coverage, they can safeguard their financial future and ensure peace of mind, ultimately leading to smarter savings in the long run.

Chapter 6: Discounts and Savings Strategies

Common Discounts Offered by Insurers

When looking for auto insurance, many drivers may be unaware of the various discounts available from insurers. These discounts can significantly reduce your premium while ensuring you maintain essential coverage. Insurers understand that certain factors can make a driver less risky, and they often provide financial incentives to encourage safer driving behaviors or to reward loyal customers.

One of the most common discounts is the multi-policy discount, which applies when you bundle your auto insurance with other types of insurance, such as home or renters insurance. This not only simplifies your insurance management by having one provider but can also lead to substantial savings on your overall premium. Insurers appreciate the reduced risk associated with customers who consolidate their policies.

Another popular discount is the safe driver discount, which rewards individuals who have a clean driving record without accidents or violations over a specified period. This discount encourages safe driving habits and helps insurers lower their risk and costs associated with claims. Many companies also offer discounts for completing defensive driving courses, further promoting road safety.

Additionally, good student discounts are available for young drivers who maintain a certain GPA in school. Insurers often recognize that students who perform well academically are likely to be responsible and cautious on the road. By providing this discount, insurers not only encourage educational achievement but also reward responsible behavior behind the wheel.

Lastly, many insurers offer discounts based on vehicle safety features. Cars equipped with advanced safety technology, such as anti-lock brakes, airbags, and collision avoidance systems, are often viewed as less risky. Therefore, drivers can enjoy lower premiums if they choose vehicles with these safety enhancements. Understanding and utilizing these common discounts can lead to significant savings on auto insurance while ensuring comprehensive coverage remains intact.

Bundling Policies for Savings

Bundling auto insurance policies can lead to significant savings for policyholders. Many insurance companies offer discounts to customers who choose to combine their auto insurance with other types of coverage, such as home or renters insurance. This strategy not only provides financial benefits but also simplifies management by consolidating multiple policies under one provider.

When considering bundling, it’s essential to compare quotes from various insurers to ensure you’re getting the best deal. Some companies offer more substantial discounts than others, so taking the time to shop around can yield better savings. Additionally, bundling can enhance your overall coverage by allowing you to tailor your policies to fit your specific needs without sacrificing necessary protections.

Another advantage of bundling policies is the potential for improved customer service. Having all your insurance needs handled by a single company can streamline communication and support. If you ever need to file a claim or require assistance, dealing with one provider can make the process more efficient and less stressful.

It’s also important to regularly review your bundled policies to ensure they continue to meet your changing needs. Life events such as moving, purchasing a new vehicle, or changing jobs can impact the types of coverage you require. Adjusting your bundled policies accordingly can help maintain optimal coverage while maximizing savings.

In conclusion, bundling auto insurance policies is a smart strategy for those looking to save money without compromising on coverage. By understanding the benefits, comparing quotes, and regularly reviewing your policies, you can effectively secure the best insurance rates available, ensuring both protection and affordability in your auto insurance needs.

Tips for Safe Driving Discounts

Safe driving is not just about obeying traffic laws; it can also lead to significant savings on your auto insurance premiums. Most insurance providers offer discounts to drivers who maintain a clean driving record, free of accidents and violations. This means that by simply following traffic rules and being a responsible driver, you can enjoy lower rates and better coverage options. It’s essential to understand the specific criteria that your insurance company uses to determine eligibility for these discounts.

Another effective way to secure safe driving discounts is to enroll in defensive driving courses. Many insurers recognize the value of these courses and reward drivers who complete them with lower premiums. These courses not only enhance your driving skills but also equip you with knowledge about road safety and accident prevention. Completing a certified defensive driving course can be a smart move, especially for new drivers or those looking to refresh their skills.

Additionally, consider using technology to your advantage. Many modern vehicles come equipped with safety features such as lane departure warnings, automatic braking, and collision detection systems. Insurance companies often provide discounts for cars that have these advanced safety technologies installed. If you are in the market for a new vehicle, prioritizing models with high safety ratings can translate into ongoing savings on your auto insurance.

Furthermore, maintaining a good credit score can influence your insurance rates. Insurers often take into account a driver’s credit history when calculating premiums. A higher credit score typically correlates with lower risk, which can lead to discounts on your auto insurance. It’s wise to regularly check your credit report and take steps to improve your score if necessary, as this can result in significant savings over time.

Lastly, don’t hesitate to ask your insurance agent about any additional discounts that may apply to you. Many companies offer benefits for a variety of reasons, such as being a member of certain organizations or having multiple policies with the same insurer. Regularly reviewing your policy and discussing potential discounts with your agent can ensure you’re getting the best rates available while maintaining comprehensive coverage.

Chapter 7: Reviewing and Updating Your Policy

When to Review Your Policy

Regularly reviewing your auto insurance policy is essential to ensure you are getting the best rates and coverage. Life circumstances can change, such as moving to a new location, changing jobs, or even starting a family. Each of these changes can impact your insurance needs and the premiums you pay. By reassessing your policy, you can identify whether your current coverage aligns with your current situation and if there are cheaper options available that don’t compromise your protection.

Another important time to review your policy is when your vehicle changes. If you purchase a new car, sell your old one, or even make significant modifications to your existing vehicle, it’s crucial to update your insurance. Different cars come with varying coverage needs, and failing to adjust your policy can lead to overpaying or being underinsured. Ensuring that your policy reflects your vehicle accurately helps in maximizing both savings and coverage.

Annual policy renewals are also a great opportunity to evaluate your auto insurance. Insurance companies often adjust their rates based on market trends, and you might find that you can secure a better deal elsewhere. Shopping around for quotes at renewal time not only gives you a chance to compare prices but also allows you to explore any new discounts or policy options that may have become available since your last review.

Additionally, if you experience a significant life event such as marriage, divorce, or retirement, it’s wise to revisit your policy. These milestones can affect your driving habits and risk levels, leading to changes in your insurance needs. For instance, combining policies with a spouse can often result in discounts, while becoming a retiree might qualify you for lower rates due to reduced driving frequency.

Finally, it’s prudent to keep an eye on your credit score and overall financial health. Insurance companies frequently use credit scores as a factor in determining premiums. If your credit score improves, you may qualify for lower rates. Conversely, if your financial situation changes negatively, it might be time to reassess your coverage options to ensure you are still adequately protected while also keeping costs manageable.

How Life Changes Affect Your Insurance Needs

Life is full of changes, many of which can significantly affect your insurance needs. Major life events such as marriage, having children, or moving to a new home can alter your risk profile and the type of coverage you require. For instance, a new family member may necessitate higher liability coverage to protect against potential risks. It’s essential to review your auto insurance policy regularly to ensure it aligns with your current life situation.

Another critical change that influences your insurance needs is your employment status. A new job, especially one that requires commuting or involves driving for work, can change how much coverage you need. Additionally, if your job provides a company vehicle, you may need to adjust your personal auto insurance accordingly. Understanding how these employment shifts affect your coverage options can help you maintain the right level of protection.

Your financial situation is also a vital factor in determining your insurance needs. Changes such as a significant increase or decrease in income can lead to adjustments in your budget for insurance premiums. With a higher income, you might consider increasing coverage limits or adding additional protections. Conversely, if your income decreases, you may need to find cheaper auto insurance quotes without compromising essential coverage.

Moreover, life changes such as retirement can also impact your insurance requirements. Retirees often drive less, which can lead to lower premiums and the opportunity to adjust their coverage accordingly. It’s crucial for retirees to assess their driving habits and adjust their policies to reflect their new lifestyle, ensuring they are not overpaying for unnecessary coverage.

Finally, keeping an open line of communication with your insurance agent is essential as you navigate these life changes. Regular consultations can help you stay informed about the best auto insurance quotes available, ensuring that you find the cheapest rates without sacrificing necessary coverage. Staying proactive about your insurance needs in response to life changes can ultimately lead to better financial protection and peace of mind.

Making Adjustments for Optimal Savings

Making adjustments to your auto insurance policy is crucial for maximizing your savings while ensuring you have the coverage you need. Many people overlook the flexibility within their policies, which can lead to unnecessary expenses. By reviewing your coverage options and understanding what you truly need, you can make informed decisions that lead to significant savings. It’s essential to take the time to analyze your situation and adjust your policy accordingly.

One effective way to cut costs is by raising your deductible. A higher deductible means that you’ll pay more out of pocket in the event of a claim, but it can significantly lower your premium. This adjustment is particularly beneficial if you have a good driving record and don’t anticipate filing frequent claims. However, ensure that the deductible you choose is something you can afford in case of an accident.

Another adjustment involves evaluating your coverage limits. While it’s important to have adequate coverage, you may find that some areas of your policy have higher limits than necessary. For instance, if you have an older vehicle, you might not need comprehensive coverage. By adjusting these limits, you can lower your premiums without sacrificing essential protection.

Additionally, consider bundling your auto insurance with other policies such as home or renters insurance. Many insurance companies offer discounts for bundled policies, which can lead to substantial savings. This approach not only simplifies your insurance management but also provides a comprehensive coverage solution at a lower cost.

Lastly, don’t forget to review your policy regularly, especially when your circumstances change. Life events such as moving, changing jobs, or purchasing a new vehicle can impact your insurance needs. Staying proactive about these adjustments will ensure you are always receiving the best rates without sacrificing coverage. By taking these steps, you can achieve optimal savings on your auto insurance while maintaining the protection you require.

Chapter 8: Common Myths About Auto Insurance

Debunking Misconceptions

When it comes to auto insurance, many individuals hold misconceptions that can lead them to make poor financial decisions. One common belief is that the cheapest insurance must mean less coverage. In reality, there are various insurance providers that offer competitive rates without sacrificing essential protections. Understanding the market can help consumers find policies that fit their budget and needs without cutting corners on coverage.

Another misconception is that all auto insurance quotes are similar, leading people to believe that comparing them is a waste of time. This couldn’t be further from the truth. Quotes can vary significantly based on factors like driving history, location, and the type of vehicle. By diligently gathering and comparing multiple quotes, consumers can uncover substantial savings and tailor their insurance to their specific circumstances.

Some people also think that they must have a perfect driving record to secure affordable insurance rates. While having a clean driving history certainly helps, many insurers offer discounts and programs designed for drivers with less-than-perfect records. Factors such as completion of driving courses or having safety features in the vehicle can contribute to lower premiums, making insurance accessible for a wider range of drivers.

Additionally, there is a widespread belief that only large, well-known insurance companies can provide the best coverage at the lowest rates. However, smaller or less recognized insurers often offer competitive rates and personalized service that larger companies may not provide. It’s important for consumers to explore all their options, including local insurers, to find hidden gems that can offer excellent value.

Lastly, many individuals think that switching insurance providers is complicated and not worth the hassle. In truth, the process can be relatively straightforward and often results in better rates and coverage. By periodically reviewing their policy and shopping around, consumers can ensure they are not overpaying for their auto insurance and can adapt to any changes in their needs or circumstances.

The Truth About Claims and Premium Increases

Understanding the relationship between claims and premium increases is crucial for anyone navigating the auto insurance landscape. Many policyholders believe that filing a claim automatically results in a hike in their premiums. However, this isn’t always the case. Insurers evaluate claims based on various factors, including the nature of the claim, the cost involved, and the driver’s history. It’s essential to know how these elements play a role before deciding whether to file a claim or pay out of pocket for minor incidents.

One common myth is that even a single claim will lead to an increase in premiums. While it’s true that insurers may raise rates after a claim, the impact often depends on the circumstances surrounding the event. For example, if you are not at fault in an accident, many companies will not penalize you with a premium increase. Understanding your policy’s specifics can help you make informed decisions when it comes to filing claims without fearing a spike in costs.

Another factor affecting premium increases is the overall claims history of a driver. Insurers often assess your past claims when determining your risk level. If you have a clean driving record and minimal claims, a single incident may not significantly impact your rates. Conversely, a history of frequent claims can lead to higher premiums. Maintaining a good driving record is vital for keeping your insurance costs down.

It’s also important to consider the type of coverage you have. Comprehensive and collision coverage can have different implications for claims and premium adjustments. If you have a higher deductible, you might be more inclined to handle smaller claims yourself, which can help preserve your premium rates. Knowing your coverage options allows you to strategize effectively and find the best balance between cost and protection.

In conclusion, while there is a connection between claims and premium increases, it is not as straightforward as many assume. By understanding your policy and the factors that influence premiums, you can make smarter decisions regarding when to file a claim. This knowledge empowers you to seek the best auto insurance quotes while ensuring you are adequately protected without breaking the bank on premiums.

Understanding Insurance Terms

Navigating the world of auto insurance can be daunting, especially when it comes to understanding the terminology often used in policies and quotes. Key terms like “premium,” “deductible,” and “coverage limits” are essential to grasp for making informed decisions. Knowing what these terms mean empowers consumers to compare quotes effectively and ensures they choose a policy that meets their needs without overspending.

A “premium” is the amount you pay for your insurance policy, usually on a monthly or annual basis. This cost can vary based on several factors, including your driving history, the type of vehicle you own, and the level of coverage you select. Understanding how your premium is calculated can help you identify potential savings opportunities and make adjustments if necessary.

The “deductible” is another critical term. It refers to the amount you must pay out of pocket before your insurance kicks in during a claim. A higher deductible typically means a lower premium, but it also means more upfront costs in the event of an accident. It’s important to balance your deductible with your financial situation to ensure you can afford it when needed.

“Coverage limits” define the maximum amount your insurance will pay for various incidents, such as property damage or medical expenses. Familiarizing yourself with these limits is vital, as they dictate the extent of protection you have. Opting for higher coverage limits can provide peace of mind, especially in serious accidents, but may also increase your premium.

Finally, terms such as “liability insurance” and “collision coverage” are crucial to understand as they play significant roles in your overall protection. Liability insurance covers damages you cause to others, while collision coverage pays for damage to your vehicle regardless of fault. Knowing these distinctions helps you select the right balance of coverage to protect both yourself and your assets effectively.

Chapter 9: Navigating the Claims Process

What to Do After an Accident

After an accident, the first step is to ensure everyone’s safety. Check for injuries and call emergency services if needed. It’s essential to move vehicles to a safe location if they are causing a hazard. Staying calm and collected during this stressful time can help you make better decisions and ensure that all necessary actions are taken promptly.

Next, gather important information from all parties involved. This includes names, contact details, insurance information, and vehicle details. Taking photos of the accident scene, vehicle damages, and any relevant road conditions can also be beneficial. This documentation will play a vital role when filing a claim and dealing with insurance companies.

Once you have collected all pertinent information, contact your insurance provider as soon as possible. Report the accident and provide them with the details you’ve gathered. Your insurance agent can guide you through the claims process and inform you about your coverage, ensuring you understand what is covered under your policy.

In the aftermath of the accident, it’s also crucial to keep detailed records of any medical treatments or repairs needed for your vehicle. This documentation will support your claim and help you track expenses related to the accident. Regularly follow up with your insurance adjuster to stay updated on the status of your claim and to ensure everything is processed in a timely manner.

Finally, consider your long-term options regarding auto insurance coverage. Review your current policy and compare it with other quotes to find the best rates without sacrificing essential coverage. Understanding your needs after an accident can help you make informed decisions about your insurance, leading to smarter savings in the future.

Filing a Claim: Step-by-Step

Filing a claim for auto insurance can seem daunting, but following a straightforward process can make it manageable. Begin by gathering all necessary documentation, including your policy number, details of the incident, and any relevant photographs. This preparation will streamline the process and ensure that you have all the information needed when you contact your insurance company.

Next, promptly report the accident to your insurance provider. Most companies have a dedicated claims department that is available 24/7. When filing the claim, be honest and detailed about what occurred. Provide a clear account of the events leading up to the incident, as well as any witnesses or police reports that may support your claim.

After submitting your claim, you will likely be assigned a claims adjuster who will investigate the situation. This professional will review the details and may reach out for additional information or clarification. It is crucial to maintain open communication with the adjuster and respond to any requests promptly. This can help expedite the claims process and lead to a quicker resolution.

Once the investigation is complete, the insurance company will determine the claim’s outcome. You will receive a decision regarding whether your claim is approved or denied, along with details about any payouts. If your claim is approved, the insurance company will outline the next steps for receiving compensation for damages or losses incurred.

If you encounter issues or disagree with the outcome of your claim, don’t hesitate to appeal the decision. Most insurance companies have a formal process for appeals, which allows you to present additional evidence or clarify misunderstandings. Staying informed about your rights and options can help ensure that you receive the coverage you are entitled to under your policy.

How Claims Affect Future Premiums

Understanding how claims affect future premiums is crucial for anyone seeking to find affordable auto insurance. When a policyholder files a claim, the insurance company evaluates it based on various factors, including the nature of the claim and the overall risk the driver presents. This evaluation often leads to adjustments in premiums, which can significantly impact the cost of insurance in the future. Therefore, being aware of how these claims influence rates can help drivers make informed decisions about their coverage options.

Insurance companies typically categorize claims into two types: minor and major. Minor claims, such as small damages or low-cost repairs, may not always lead to a significant increase in premiums, especially if the driver has a clean record. However, major claims, like those involving serious accidents or substantial vehicle damage, often result in a noticeable spike in premiums. This differentiation is essential for drivers to understand, as it highlights the importance of maintaining a good driving record to keep costs down.

Another important aspect is the claims history that insurers review when determining premiums. A history of multiple claims can label a driver as high-risk, even if some claims were minor or unavoidable. This classification can lead to higher rates not just from the current insurer, but also from future providers who access the driver’s claims history. Therefore, minimizing the number of claims filed, when possible, can help maintain lower premiums over time.

Additionally, some states have regulations that affect how much a claim can influence future premiums. For example, certain states may prohibit insurance companies from raising rates after a first accident, provided the driver was not at fault. Understanding these local laws can empower drivers to make better choices regarding when to file claims and when to pay out of pocket for minor repairs. This knowledge can ultimately lead to significant savings on future premiums.

In conclusion, being proactive about understanding the relationship between claims and future premiums is vital for anyone looking to save money on auto insurance. By keeping a clean driving record, being strategic about filing claims, and staying informed about local insurance laws, drivers can effectively manage their insurance costs. This proactive approach not only helps in securing the best rates but also ensures that coverage remains adequate without unnecessary financial burden.

Chapter 10: Future Trends in Auto Insurance

The Impact of Technology

Technology has significantly transformed the landscape of auto insurance, making it easier than ever for consumers to find the best quotes. With the rise of online platforms and mobile applications, individuals can now compare rates from multiple insurers in just a few clicks. This accessibility has democratized information, empowering consumers to make informed decisions about their auto insurance needs without the hassle of traditional methods.

The introduction of telematics has further revolutionized the industry by allowing insurers to assess driving behavior more accurately. By using devices that track speed, braking, and other driving habits, insurance companies can offer personalized rates based on individual risk profiles. This not only encourages safer driving but also provides savings opportunities for responsible drivers who may have previously been overlooked by conventional rating systems.

Artificial intelligence (AI) plays a crucial role in enhancing customer service within the auto insurance sector. Chatbots and virtual assistants are now commonplace, providing instant support and guidance to users seeking quotes or policy information. This technological advancement streamlines the process, reducing waiting times and improving customer satisfaction, as people can quickly resolve their inquiries without needing to speak directly with an agent.

Moreover, technology has facilitated the rise of comparison sites that aggregate quotes from various providers, allowing users to easily identify the cheapest options available. These platforms often include filters for coverage preferences, ensuring that consumers do not sacrifice essential protections in their quest for lower rates. By presenting clear comparisons, technology helps users navigate the complexities of auto insurance more effectively.

Finally, the impact of technology extends beyond obtaining quotes; it also influences claims processing and management. Digital tools enable faster and more efficient claim submissions, often allowing policyholders to file claims through mobile apps. This innovation not only expedites the claims process but also enhances transparency, as customers can track the status of their claims in real time, fostering trust in their insurance providers.

Understanding Usage-Based Insurance

Usage-based insurance (UBI) represents a transformative shift in how auto insurance is priced. Unlike traditional insurance models that rely on broad metrics such as demographics and historical data, UBI tailors premiums based on actual driving behavior. This innovative approach utilizes telematics technology, which collects data on factors like speed, braking habits, and the time of day when driving occurs. This means that responsible drivers can potentially save significantly on their insurance costs by demonstrating safe driving patterns.

The appeal of usage-based insurance lies in its fairness; drivers are rewarded for their safe driving practices. For instance, if a person drives infrequently or primarily during low-risk times, they may qualify for lower rates. Moreover, UBI encourages better driving habits by providing feedback to drivers about their behaviors on the road. This not only promotes safety but also leads to fewer accidents, which benefits both insurers and policyholders alike.

However, it’s essential for consumers to understand the implications of enrolling in a UBI program. While the potential for savings is considerable, there are privacy concerns associated with tracking driving habits. Enrolling in such a program means sharing personal data with the insurance company, which can lead to apprehensions for some individuals. It’s crucial to weigh the pros and cons, ensuring that the potential savings outweigh any discomfort regarding data privacy.

Additionally, usage-based insurance may not be suitable for everyone. Drivers with erratic schedules or those who travel frequently may find that UBI does not provide the savings they expect. It’s important to compare traditional insurance quotes alongside UBI options to determine which would offer the best financial benefit based on individual driving patterns. Some may discover that a conventional policy with comprehensive coverage is more aligned with their needs.

In conclusion, understanding usage-based insurance can empower consumers to make informed decisions about their auto insurance needs. By evaluating their driving habits, comparing quotes, and considering privacy implications, drivers can navigate the insurance landscape more effectively. As the insurance industry evolves, embracing technologies like UBI may well lead to smarter savings and better protection on the road.

Predictions for the Auto Insurance Industry

The auto insurance industry is poised for significant transformations in the coming years, driven by advancements in technology and changes in consumer behavior. As more drivers turn to digital platforms for their insurance needs, companies that adapt to these trends will likely thrive. Insurers are expected to leverage data analytics to better understand risk profiles, allowing them to offer more personalized quotes and coverage options that meet individual consumer needs.

In addition to technological advancements, regulatory changes will also play a crucial role in shaping the future of auto insurance. Policymakers are increasingly focused on consumer protection and transparency in pricing. This focus may lead to new regulations that require insurers to provide clearer information about coverage options and pricing structures, making it easier for consumers to compare quotes without feeling overwhelmed.

Another key prediction for the auto insurance industry is the rise of usage-based insurance (UBI) models. These models allow consumers to pay premiums based on their actual driving behavior rather than traditional factors such as age or credit score. As telematics technology becomes more widely adopted, consumers will have greater control over their premiums, incentivizing safe driving habits and potentially lowering costs for those who drive responsibly.

Moreover, the impact of electric and autonomous vehicles cannot be overlooked. As these vehicles become more prevalent, insurance companies will need to re-evaluate their risk assessment models. The unique characteristics of electric and self-driving cars may lead to new types of coverage and pricing structures that better reflect the reduced risk of accidents and environmental concerns associated with these vehicles.

Finally, the ongoing shift towards online purchasing and customer service will continue to redefine the auto insurance landscape. Consumers increasingly expect seamless, digital interactions with their insurers, from obtaining quotes to filing claims. Companies that invest in user-friendly digital platforms and excellent customer service will likely capture a larger share of the market, as they cater to the evolving preferences of today’s tech-savvy consumers.